Does your company have a corporate giving program? If not, starting one can provide valuable benefits, including improved employee engagement, tax deductions, and the chance to positively impact your community. However, knowing how to start a corporate giving program and actually starting one are two different things.

Corporate social responsibility (CSR) programs of any kind require planning on various fronts, such as what type of programs you’ll offer, how each program will be structured, if there are any legal requirements to consider, and how you’ll sustain your programs long-term.

One core element of modern corporate giving management is software. Of course, the sheer variety of potential CSR programs also means there is a wide variety of corporate giving solutions to consider.

To help your corporation invest in the right software, this guide will explore a few popular types of corporate giving programs and what to look for in their corresponding software. But first, let’s take a look at whether starting a corporate giving program is the right move for your business.

Should my company have a corporate giving program?

CSR programs provide employees, communities, and businesses with a range of benefits. Before launching such a program, businesses should first consult their finances to determine if they have the stability and resources to set up a CSR program.

Additionally, one overlooked factor is work culture. CSR programs only function if employees buy into them. Businesses with dedicated employees who care about their communities will still need to make an effort to inform employees about their CSR efforts. From there, they should have little trouble encouraging participation.

Starting a corporate giving program can also create a positive feedback loop when it comes to attracting new motivated employees and engaging your current ones with its many benefits, such as:

Improved Reputation

Employees want to work for corporations they believe in, especially Gen Z employees who are entering the workforce en masse. With over half of Gen Z workers claiming they would take a pay cut to work at a business with ethics that align with theirs, a strong corporate giving program is a simple way to appeal to these socially conscious employees.

In addition to recruitment, improving your reputation through CSR has other benefits, such as:

- Positive customer reception. Just as employees want to work at businesses that make a positive difference in the world, customers want to spend money at businesses that will use it for social good. Publicizing your CSR efforts can improve your company’s reputation among consumers, leading to more business.

- Better work culture. When you attract employees who are interested in your corporate giving program, you’ll slowly build a team of individuals committed to social good. This can also be an effective way to engage remote employees in your work culture. These employees have few ways to connect with others, but they can still do their part to contribute to your corporate giving program.

- Marketing opportunities. When your corporation is known for making a positive difference in your community, more organizations will want to work with you. For example, nonprofits will ask for sponsorships in exchange for promoting your business, other businesses will want to be associated with yours, and employees will be happy to talk up your organization during their off hours.

Of course, for your corporate giving program to make a significant difference in your company’s reputation, you’ll need to promote it to employees, document your results, and share your impact with your community.

Increased Employee Motivation

Employees are motivated by several factors, such as compensation, opportunities for growth, a positive work environment, and good relationships with co-workers. Another important factor is whether employees feel their work contributes to a good cause.

While employees at for-profit companies know their work is being used to generate revenue first and foremost, they also want to know that excess profits are going to good causes. After all, would you feel more motivated to work at an organization known for failing pollution scores or one that donates a portion of its proceeds to cleaning up oil spills?

On that same note, CSR can help clean up a company’s reputation if it had missteps in the past. Committing to righting the wrongs of past leadership decisions can be an effective story that demonstrates to consumers and employees that you’re dedicated to turning over a new leaf and making a more positive future.

Easy Benefits Package Addition

Employees consider a variety of factors when they look at compensation packages. These include salary, overtime pay, paid time off, and health insurance. To put your business over the top when compared to other organizations, add opportunities to participate in CSR programs.

Marketing your business as a generous employer that cares about the same causes its employees do can make you stand out to top talent. Given the sheer number of Gen Z workers who would be fine taking a pay cut if it meant working for an employer with a commitment to social good, imagine the number of talented employees you will be able to attract by offering competitive benefits and a corporate giving program.

Why should my company invest in corporate giving software?

The right tools can help your company maximize its philanthropic impact and encourage employees to complete their gifts. Plus, the availability of accessible and affordable tools opens corporate giving participation to a wide range of employers, according to Double the Donation.

The right tool can help you unlock the value of corporate giving by:

- Educating your employees. Many employees don’t know about corporate giving programs, which is why an estimated $4-7 billion in matching gifts goes unclaimed every year. With the right tool, employees can find your company’s corporate giving information directly from a nonprofit’s website after donating.

- Maximizing your impact. Supporters are more likely to donate when they know about matching gifts, but this knowledge also makes them more likely to give more. One-third of donors will give a bigger gift if they know a match is being offered, meaning your company can maximize the impact it makes through charitable donations by investing in the right tool.

- Partnering with nonprofits. Your investment in the right software solution can help you identify corporate giving opportunities and make your company a well-known contributor. By deepening your connection with charitable organizations, your company will become more than just a sponsor or program participant—you’ll engage in a long-term partnership to give back to your community.

Thoroughly vet your software options before settling on a solution. The right tool will aid your company’s unique philanthropic efforts and help you identify more opportunities to give.

Matching Gifts

What are they?

Matching gifts are a system of corporate giving wherein employees donate to causes they care about, report the donation to their employer, and the employer then makes a donation, usually equal to that of the employee, to the same nonprofit.

Matching gifts are a popular type of corporate giving as employees can control what causes receive support, meaning they know your business is supporting the issues they care about specifically.

When setting up a matching gift program, consider the following stipulations for matching gift requests:

- What types of organizations will you match gifts for? Often, corporations add matching gift requirements based on organization type, such as matching for all types of nonprofits except schools and churches. Others will have a specific philanthropic mission and only match gifts to organizations whose work fulfills that mission.

- Which employees are eligible for matching gifts? While full-time employees are usually match eligible, consider whether part-time and retired employees can also have their gifts matched. Some particularly generous companies will even match gifts by employees’ spouses.

- Is there a minimum or maximum donation amount? Will you require employees to donate a minimum amount, and is there a maximum you will match up to? Does this maximum apply to individual donations, or will it be the threshold for the entire year? Additionally, consider the ratio you’ll match at. Most corporations stick with a 1:1 ratio, meaning they’ll match at a dollar-for-dollar rate. However, some companies give at 2:1 or even 3:1 rates. Conversely, some with smaller budgets give at just a 0.5:1 rate.

- When is the deadline to submit gifts? Common deadlines for matching gift applications include a specific number of months after the initial donation was made (usually six or twelve), the end of the calendar year, and the end of the fiscal year. Some companies also establish grace periods to accommodate donors who give late in the year, such as allowing gifts given in December to be eligible for matches until the following April.

- What information do you need about the nonprofit to verify the gift? Most companies usually request employees provide the nonprofit’s name, address, and tax ID on their matching gift application. For the donation amount, some organizations let employees report the amount themselves and take them at their word whereas others request a copy of their donation receipt.

Additionally, consider your program budget, how employees will submit matching gift applications, who will review the applications, and how you’ll collect data on your matching gift program’s accomplishments.

What software do I need?

To solve the potential dilemmas previously outlined, corporations partner with matching gift database vendors to add their business’s information to popular matching gift search tools. Employees who make donations can then look up your company’s name and get paired with relevant matching gift information.

For employees who give to nonprofits without matching gift software, make sure your matching gift information and application form are clearly available online for employees. You can track and approve their gifts in your corporate giving software.

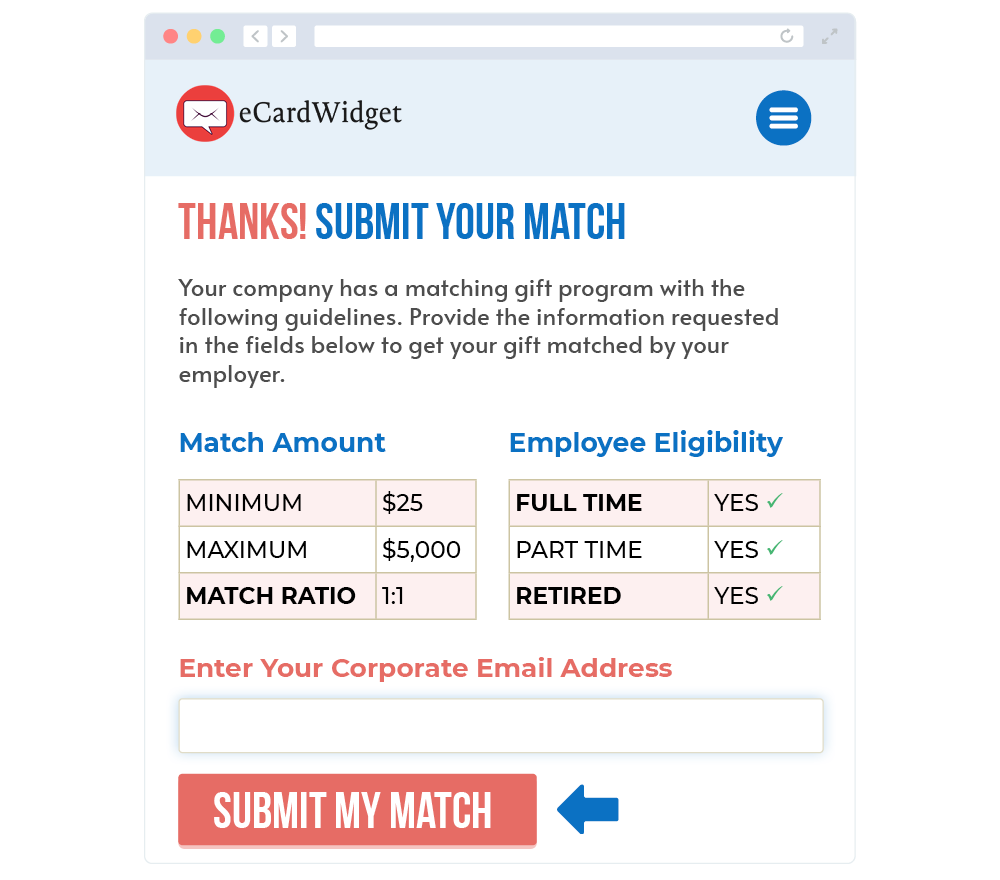

Speaking of corporate giving software, go the extra mile by choosing a CLMA-certified solution that offers matching gift auto-submission functionality. This feature allows supporters who give to nonprofits that use matching gift software to have their match request forms automatically completed for them.

Essentially, the technology pulls information an employee provides during the donation process, such as their name and giving total, as well as your matching gift form from your CSR platform. All employees need to do is confirm their employer during the donation process and check a box to opt into auto-submission.

Suffice it to say, when employees have their matching gift applications completed in seconds, companies can expect to see participation in their workplace giving programs go up.

Volunteerism

What is it?

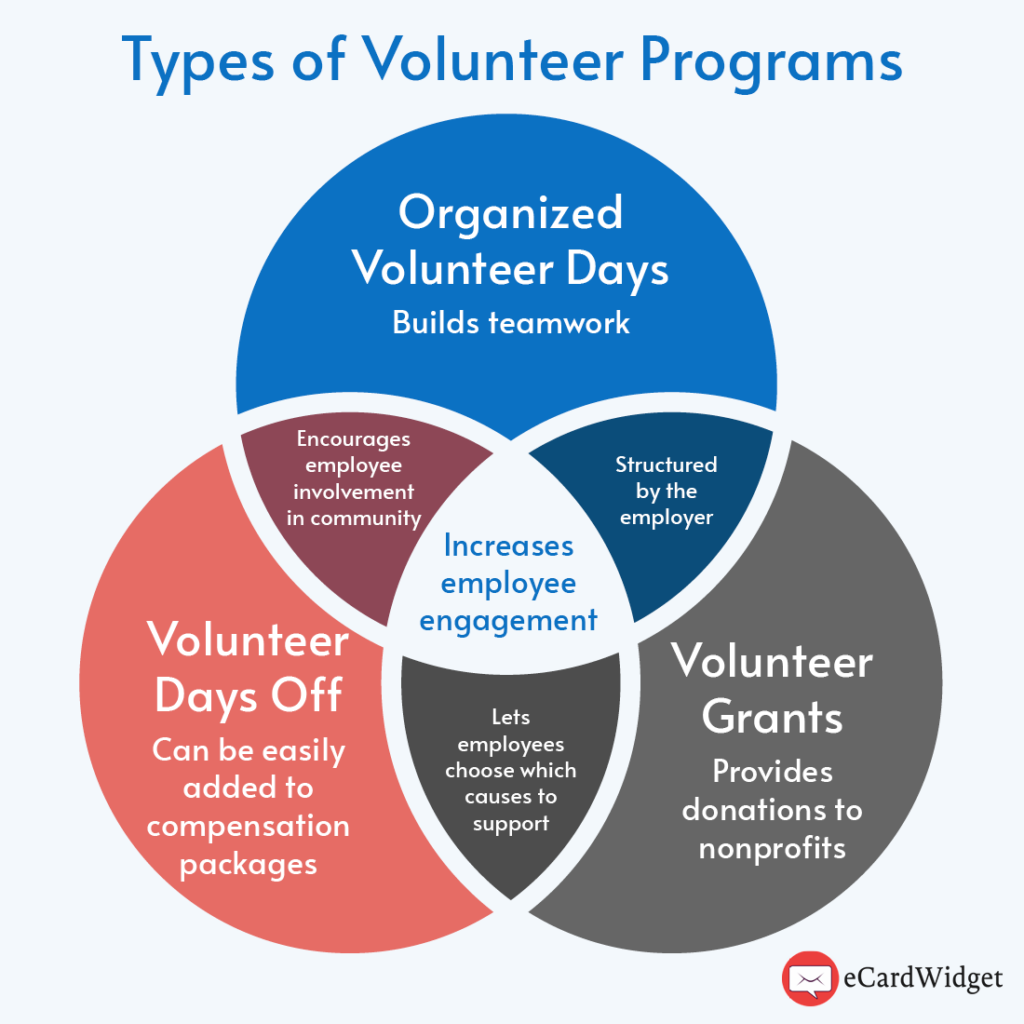

Corporate volunteerism includes a variety of ways companies can encourage their employees to get involved in their communities. Here are a few examples of corporate volunteer programs that might work for your organization:

- Organized volunteer days. Partner with a local nonprofit and host a corporate volunteer day. Your staff will volunteer together as a group, allowing them to enact social good and engage in team-building activities.

- Volunteer grants. Support your employees by donating to the nonprofits where they regularly volunteer. Similar to matching gifts, set requirements for what types of organizations you’ll provide volunteer grants for, how many hours employees must volunteer for to qualify, and how much you’ll give per hour volunteered.

- Volunteer time off. In addition to regular PTO, give employees a specific number of days a year they can take off specifically to volunteer. To verify the results of this program, ask employees to provide the name of the nonprofit where they volunteered and a log of their hours.

Promoting volunteering is good for your community and your business. Studies show that employees who work at companies with employee volunteer programs are five times more engaged than their counterparts. Consider implementing one of these programs to boost your company’s reputation and workplace satisfaction.

What software do I need?

While most CSR initiatives require a corporate giving platform that tracks donations, volunteer-related programs need the ability to track hours individual employees worked at various nonprofits. Create a time log that your CSR supervisor oversees, or take a more hands-off approach by letting employees report their own volunteer hours.

For volunteer grants, you will still need corporate giving software to verify nonprofits, accept volunteer grant applications, and distribute grant funds to approved applications.

Employee Assistance Funds

What are they?

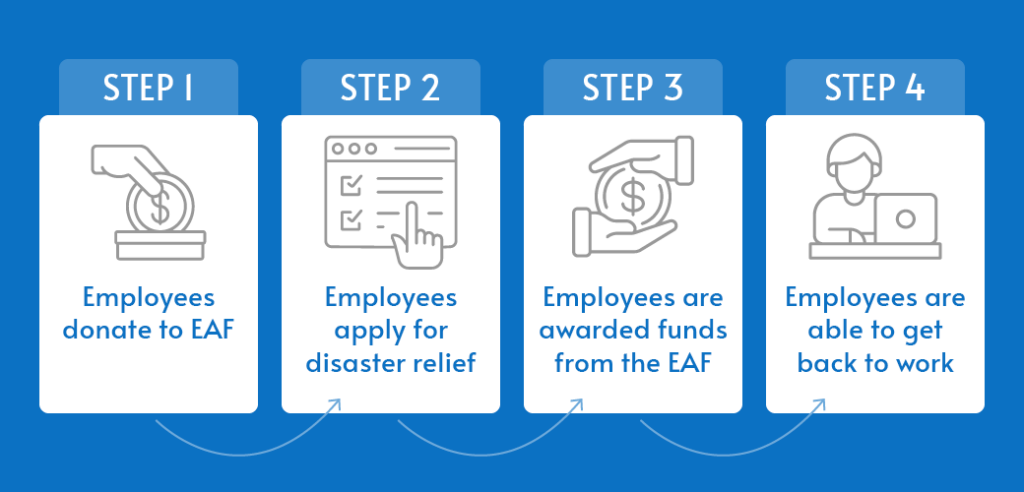

Employee Assistance Funds (EAF) are a method of corporate philanthropy that looks inward rather than focusing on the external community. Essentially, EAFs are funds created for a company’s employees to support them in the event of intense financial hardship. Here’s how these programs work:

For example, a chain store may have branches across California, including locations that experience annual wildfires. In the event of an environmental disaster, the employees at those locations may be out of work until the stores are safe to return to, and some may even experience a disruption in housing. With an EAF, these workers would receive financial benefits to help themselves and their families during this difficult time.

In addition to protecting workers going through challenging times, EAFs have several other benefits, including:

- Instilling a sense of teamwork and camaraderie. EAFs mean your team members are supporting each other. Suppose the employer agrees to also contribute to the EAF or match employee donations. In that case, employees will be even more motivated since their workplace doing well actively helps their future in the event of an emergency.

- Protecting employee privacy. Government assistance programs are also useful to employees in situations where they need EAF resources, but these usually have more red tape and long wait times. In contrast, EAFs are a discreet way employees can apply for financial assistance by getting in contact with an employer who is likely already familiar with their situation.

- Clear incentives for participation. It can sometimes be challenging to find a cause all of your employees are equally passionate about supporting, and even with a universally agreed good cause, participation in CSR activities can still be spotty. With EAFs, employees are effectively investing in their own security.

There are a variety of ways an EAF can be set up as well. These include:

- Private foundation. Private foundations provide corporations with control over how their EAF is funded and managed. However, awarded funds are taxable, and there are limitations on what situations funds can be awarded to combat. For example, funds may only be able to be spent on disasters declared by the U.S. president or disasters that fall under the Federal Emergency Management Agency.

- Public foundations. Public foundations have a lot in common with private foundations with a few exceptions in how they are managed. For instance, a public foundation must maintain the same structure as a 501(c)(3), particularly meaning that 50% of board members must be unrelated through blood, marriage, or business relations. Otherwise, public foundations provide the most flexibility in what can be considered a disaster and subsequently awarded funds.

- Third-party organizations. Rather than starting an EAF from scratch, your company may partner with a nonprofit that already has experience managing and distributing funds in emergencies. Contributions to this charitable fund will be tax-free for your business and your employees, and relief funds given to employees can be included in your corporate write-offs.

If you’re interested in setting up an in-house EAF, you’ll need robust financial management tools.

What software do I need?

Essentially, organizations will need a CSR platform that allows them to:

- Collect donations. Allow employees to give through your CSR interface. Some corporations encourage employees to opt in by signing up for automatic paycheck deductions that are added to the EAF.

- Process applications. Use a CSR platform that allows you to create application forms employees can submit if they need help from the EAF. Choose a platform with strict security measures to protect your employees’ confidentiality when they apply.

- Distribute funds. Manage the total amount in the EAF to decide how funds are allocated and distributed to specific applicants.

Ensure your CSR platform is user-friendly enough that employees can interface with it to make additional donations at their leisure. Additionally, businesses with multiple locations will need a robust platform that allows them to track large funds and make strategic decisions about awarding them to benefit the most employees possible.

Scholarships

What is it?

Corporate scholarships are provided to college students by a corporation rather than the government or a foundation. In contrast to other types of corporate philanthropy, scholarships have a very specific purpose: helping low-income students complete their higher education without taking on a massive financial burden.

Some corporate scholarship programs have requirements for the students applying. One common requirement is that they have parents who work for the business in some capacity. Similar to EAFs, this limitation can actually increase employee buy-in as they know they’ll be investing in their own children’s education whenever they donate to the scholarship fund.

What software do I need?

To run a scholarship program, businesses need corporate giving software with the following features:

- User-friendly donation portal

- Ability to create application forms

- Ability to distribute funds to applicants

- Reporting tools to monitor impact

Additionally, organizations interested in a scholarship program should consider using software that facilitates the application review process. This might involve making applications anonymous to avoid potential bias, enabling multiple reviewers to leave comments on applications, and creating a weighted score based on judging criteria.

Corporate Giving Software Resources

The best corporate giving program for your organization depends on your employees, business model, and overall company values. Whichever program you launch, ensure you have software that backs up your efforts and makes participation easy.

Of course, this is just the beginning when it comes to the wide world of corporate giving software. To learn more about how to establish your program, how to connect with employees, and what tools to invest in, explore these resources:

- A Guide to Building a Strong Workplace Culture Remotely. Remote employees are also part of your company and have the potential to participate in corporate giving as well. Learn how to bring them into your company culture of giving.

- 10 Best Remote Work Software Solutions To Boost Engagement. Software shapes your ability to engage with remote and hybrid workers. Discover 10 platforms to improve communication and collaboration with these remote employees.

- How to Master the Hybrid Workplace Model to Engage Employees. A hybrid work model has many benefits, but it can also throw a wrench into establishing a consistent company culture. Improve your hybrid workplace model with these tips.